Home Loans and Refinancing

Think it's time to enjoy the fruit of your efforts?

Discuss cash-out refinance options with our experts.

Average credit, low income, or low downpayment? You still have options!

Educate yourself by reading our experts' advice on the links above!

Talk to us today to lock in an all-time low rate!

We take great pride in providing a seamless and efficient experience for our clients. Here’s what sets us apart:

1. Fast Closings

We specialize in quick transactions, with the ability to close deals in as little as two weeks, ensuring a smooth and hassle-free process.

2. Low Closing Costs

Our commitment to affordability means we offer some of the lowest closing fees in the industry, helping our clients maximize their savings.

3. Proven Reputation

We maintain an A+ rating with the Better Business Bureau (BBB), a testament to our dedication to integrity, transparency, and exceptional service.

4. Experience You Can Trust

With over 11 years in business, we have built a strong track record of successfully serving our clients, backed by extensive industry knowledge and expertise.

30 year

- Low Monthly Payments for Easier Budgeting

- Predictable Long-Term Costs Without Surprises

- More Flexibility for Savings and Investments

15 year

- Pay Off Loan Faster, Save Interest

- Build Home Equity Much Quicker

- Lower Interest Rates Compared to 30-Year

Affordable Home Refi

- Reduce Monthly Payments for Better Cash Flow

- Access Home Equity for Additional Funds

- Lower Interest Rates, Save on Payments

Learning Center

Real estate investment trusts – A Reliable Leading Housing Indicator

Real estate investment trusts, or REITs for short, are investment vehicles used by businesses and individuals to invest in a diversified group of real estate

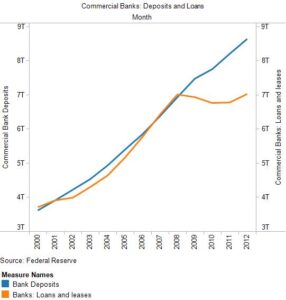

How Does Slow Lending Affect You?

We all knows that banks have been giving out loans much slower in the last few years than they have before. But have we considered

Should You Buy Mortgage Origination and Discount Points?

When you purchase your first home, you will be inundated with terms you may find difficult to understand. This is not your fault. The American

4 Reasons to Choose Us as Your Lender

1. Transparency You Can Trust

We guarantee no hidden fees and no surprises—ever. You’ll always know exactly what to expect.

2. Efficient and Reliable Service

Our streamlined processes, including electronic signing and paperless documentation, help us meet deadlines and reduce hassle for you.

3. Honesty Above All

We prioritize your financial well-being. That means telling you the truth, even when it’s not what you want to hear—because integrity comes before business.

4. Proven Satisfaction

With two-thirds of our business coming from repeat customers and referrals, our focus is on building lasting relationships and ensuring you’re genuinely satisfied.